BAD NEWS for home buyers: U.S. house mortgage rates SKYROCKET to HIGHEST level in two decades

08/27/2023 / By Belle Carter

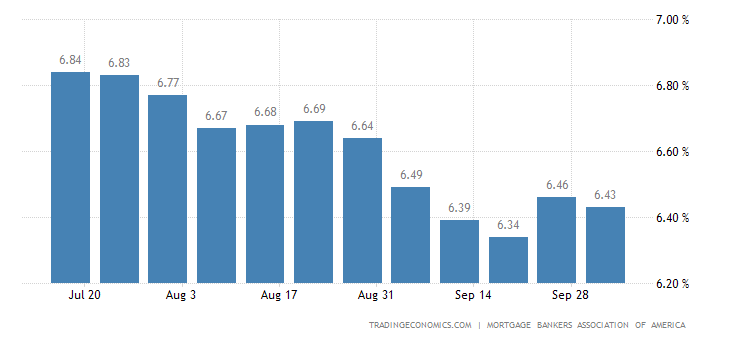

There is bad news for anyone looking to buy a home in the near future. The Mortgage Bankers Association (MBA) recently reported that mortgage rates in America surged to their highest level since late 2000 last week.

The 30-year fixed mortgage rate increased 15 basis points to 7.31 percent in the week ended Aug. 18. As a result, this sent a key measure of demand down to the lowest level in nearly three decades. The overall gauge of mortgage applications, which also includes refinancing, went down to 184.8, near the lowest level since 1996.

“Applications for home purchase mortgages dropped to their lowest level since April 1995, as homebuyers withdrew from the market due to the elevated rate environment and the erosion of purchasing power,” said Joel Kan, MBA’s vice president and deputy chief economist. “Low housing supply is also keeping home prices high in many markets, adding to the affordability hurdles buyers are facing.”

According to ZeroHedge‘s Tyler Durden, the reason for the collapse is simple. The average monthly mortgage payment has exploded to a record $2,322 per month — more than double from pre-pandemic levels. This is considering housing affordability at or near the lowest on record with the average monthly mortgage payment being based on a median home price and an average 30-year fixed-rate mortgage, and assuming a 20 percent down payment.

And this is not the end of the line. According to Mortgage News Daily, borrowing costs have continued to soar this week, with the 30-year fixed rate hitting almost 7.5 percent on Tuesday.

All of this can be traced back to how the Federal Reserve continues to raise interest rates because it believes the U.S. has a “resilient economy.” Fed Chairman Jerome Powell will speak at the central bank’s annual Jackson Hole symposium later this week. Minutes from policymakers’ previous gathering reflected that most officials still saw significant upside risks to inflation, which could require further rate hikes.

Look for the chain reaction to the elevated mortgage rates and still-high home prices that would put further strain on the residential housing market. According to a Bloomberg report, the latest housing data further illustrate the trend – homeowners are reluctant to move and take on a higher mortgage rate, so prospective buyers are seeking out new construction instead.

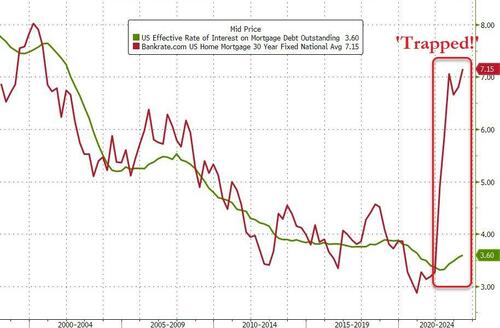

Durden’s article also included the chart below, where the average effective mortgage rate (on outstanding mortgages) is 3.6 percent, half of the actual 30-year mortgage. This just means that tens of millions of homeowners are trapped and unwilling to sell as they would have to refi at a sharply higher rate.

The Fed claims that when it slashed its interest rate target to near zero during the Wuhan coronavirus (COVID-19) pandemic and held it there for two years, the mortgage rates plunged to historic lows. It fell to below three percent for some time. Due to this, homebuyers rushed out to lock in ultra-low rates which in turn, sent demand soaring and causing the housing market to become red-hot. Home prices also soared because of the high demand.

Then in March last year, the Fed began hiking rates. Soon mortgage rates began going up again, which caused housing prices to decrease because demand also declined. But now, with mortgage rates above seven percent, a new dynamic has emerged and heated the market back up a bit. (Related: As home prices drop, 270,000 Americans who bought homes this year are already underwater on their mortgage.)

Because so many people who locked in sub-three percent mortgages now would face high rates, they are refusing to put their existing homes on the market because they want to hold onto their super-low mortgages. That means the housing supply has dwindled and put pressure on new home sales, which have increased as a result, MarketWatch explained in an article.

Visit HousingBomb.com to read more stories related to America’s collapsing housing market.

More related stories:

30-year fixed mortgage rate surges above 7% as the Fed continues to raise interest rates.

Mortgage rates surge to 20-year high, causing massive drop in home sales.

New home construction SOARS to three-decade high in May despite rising interest rates – but WHY?

Sources include:

Submit a correction >>

Tagged Under:

affordability, big government, Bubble, chaos, Collapse, conspiracy, debt bomb, debt collapse, deception, economic collapse, economic crisis, economic riot, economy, financial collapse, financial crisis, fixed-rate mortgage, home applications, home buyers, home loan applications, home purchase, home sales, homes, housing bomb, housing bubble, Housing Market, Inflation, interest rates, lies, market crash, median home price, mortgage, Mortgage Bankers Association, mortgage rates, politics, propaganda, Real Estate, recession, risk

This article may contain statements that reflect the opinion of the author

Get independent news alerts on natural cures, food lab tests, cannabis medicine, science, robotics, drones, privacy and more from NewsTarget.com

Get independent news alerts on natural cures, food lab tests, cannabis medicine, science, robotics, drones, privacy and more from NewsTarget.com

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 DEBT COLLAPSE NEWS