CRYPTO CARNAGE: Bankman-Fried ‘lent’ billions in customer funds to his trading firm, setting the stage for implosion

11/10/2022 / By News Editors

Alameda Research – Sam Bankman-Fried’s (SBF) FTX-affiliated crypto hedge fund – “owed” FTX $10 billion after the exchange “lent” billions of dollars of sacrosanct customer assets to fund risky bets, just as we suspected… only even more!

(Article by Tyler Durden republished from ZeroHedge.com)

If @SBF_FTX took $6 billion in client funds from FTX and secretly syphoned them to fund his “teenage investing wizards” at Alameda, he should go to prison for a long time.

— zerohedge (@zerohedge) November 9, 2022

That, as The Wall Street Journal reports, citing a person familiar with the matter, is what set the stage for the carnage and chaos across the crypto space that has happened in the past few days as the reality of FTX’s alleged commingling of funds and massive shortfall became public thanks to Binance’s CZ’s due diligence and CoinDesk’s reporting.

FTX extended loans to Alameda using money that customers had deposited on the exchange for trading purposes, a decision that Bankman-Fried described as a “poor judgment call.”

All in all, FTX had $16 billion in customer assets, according to the person, so FTX lent more than half of its customer funds to its sister company Alameda.

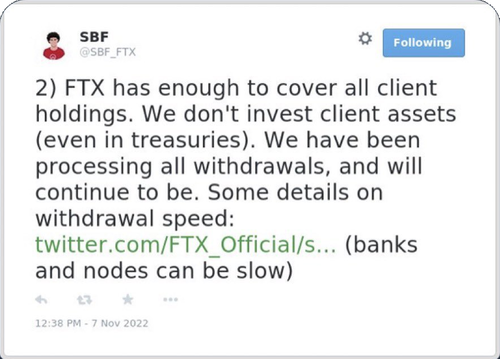

SBF tweeted at the beginning of the week as information started to leak and the ‘bank run’ accelerated that FTX had the funds to cover all client holdings…

… but that tweet has since been deleted as it would be Exhibit A in the prosecution’s case to throw the 30-year-old in prison.

The problem was that Alameda had a giant, growing hole in its balance sheet. As @MiniGrogu explains:

On Nov 2nd, CoinDesk published an article on Alameda Research leaked Q2 balance sheet.

Against $8b in liabilities, Alameda accounted for $14.6b of assets.

The primary asset was “$5.82 billion” of “unlocked” and “collateral” FTT (market cap at the time was approx $3.1b).

To be clear, Alameda marked the value of their FTT bag at 193% of known market cap at a time where only 200-300 addresses actively traded the token.

How much of this “5.82 billion” do you think they could have realized before all FTT bids fled the order book?

The rest of the assets were equally abysmal: $1b+ of SOL (~10% of market cap), $2b+ of other illiquid altcoins (SRM, MAPS, OXY, and FIDA), and $2b of “investment in equity securities”

Put another way, @MiniGrogu concludes:

“Alameda was running the Celsius playbook”

And we know how that ended.

More recently Alameda had become one of the biggest players in “yield farming,” or investing in tokens that pay interest-rate-like rewards. Yield farming can be risky because the tokens often have an initial run-up in price as investors pile in, seeking the rewards, then a crash as they get out.

“It’s essentially like picking up pennies before a steamroller,” said independent blockchain analyst Andrew Van Aken.

“You use dollars, or stablecoins, to get these very speculative coins.”

Well the fingers got caught under the roller-coaster as prices across the crypto-space spiralled lower and the vicious circle put recovery out of reach, prompting the ever-increasing need for FTX client funds to fill the void.

So, given what The Wall Street Journal is reporting – that SBF either directly invested client funds or used them as collateral to plug gaping holes in Alameda’s mid-priced balance sheet – that must be illegal right?

Well… maybe, maybe not.

As @MiniGrogu explains in a detailed tweet thread, the answer is “well, it’s not clear.”

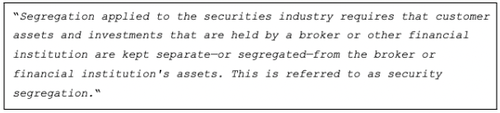

In traditional markets under US jurisdiction it’s clearly illegal, brokers must keep client funds segregated from other company assets and regulators can punish violations.

In their User Agreement, FTX does state that the Customer Account is a self-directed account, meaning ALL orders/directions involving the account are executed at the request of the user.

HOWEVER, the same is not true for ‘margin accounts’…

Absent from the TOS or User Agreement, but present in the whitepaper, is a statement that collateral for margin accounts is held in a “Centralized Collateral Pool”

As @MiniGrogu concludes, “This is likely the hole.”

This means that while all signs point to clear fraud, it is not immediately clear that SBF did something illegal here – unethical yes… but illegal not-so-clear given the TOS.

Nevertheless, while we are sure this will lead to demands from lawmakers to “do something” – and by ‘something’ they mean regulate the shit out of the crypto business…

Maxine Waters – Chair of the House Financial Services Committee – wasted no time in demanding ‘more’ regulation…

“The recent fall ofFTX.com – a major international cryptocurrency trading platform – is just the latest example in a string of incidents involving the collapse of cryptocurrency companies and the impacts these failures have on consumers and investors. Although FTX’s U.S.-facing company is reportedly operational, FTX’s FTT tokens are now worthless, and even worse, FTX.com customers are completely unable to access their funds.

Now more than ever, it is clear that there are major consequences when cryptocurrency entities operate without robust federal oversight and protections for customers.

For four years, under my leadership as Chairwoman, the Committee on Financial Sendees has led the way in examining and investigating the cryptocurrency marketplace. This includes the Committee’s formation of Congress’ first-ever Task Forces on Financial Technology and Artificial Intelligence, along with the working group on digital assets. In addition, for several months, I’ve been working around the clock with Ranking Member Patrick McHenry to craft bipartisan legislation that establishes a federal framework for stablecoins in order to begin building the safeguards needed to protect customers’ assets and insulate our financial markets from contagion.

This week’s news further highlights the urgent need for legislation.”

Oh really Maxine?

(reminder, after George Soros, Bankman-Fried was the largest donor to Democrats in the Midterms).

…we would remind readers that there is nothing special about crypto in this situation…

Jon Corzine used plain old dollars to embezzle client funds at MF Global. It’s not just crypto – clearly the entire fiat system is broken as well.

— zerohedge (@zerohedge) November 10, 2022

MF Global customers were ultimately made whole after a years-long bankruptcy process. With FTX, operating in the less regulated world of crypto, it is unclear whether customers will ever get their money back.

But, fraudsters gonna fraud, whether it is with fiat or with crypto.

In fact, this is a total failure of trust and once again goes to weakness of centralized systems… which ironically, only crypto can fix.

Earlier this morning, in a lengthy mea culpa, SBF said in a tweet that Alameda Research was winding down trading.

Read more at: ZeroHedge.com

Submit a correction >>

Tagged Under:

Alameda, Bubble, Collapse, conspiracy, corruption, crypto, currency crash, debt bomb, debt collapse, deception, fraud, FTT, FTX, implosion, market crash, money supply, risk, Sam Bankman-Fried, traitors

This article may contain statements that reflect the opinion of the author

Get independent news alerts on natural cures, food lab tests, cannabis medicine, science, robotics, drones, privacy and more from NewsTarget.com

Get independent news alerts on natural cures, food lab tests, cannabis medicine, science, robotics, drones, privacy and more from NewsTarget.com

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 DEBT COLLAPSE NEWS