Government lost as much as $100 billion to stimulus money fraud during COVID-19 pandemic

08/19/2022 / By Mary Villareal

The U.S. lost as much as $100 billion in funds as government programs got abused by applicants for benefits and aids related to the Wuhan coronavirus (COVID-19) pandemic.

Since the beginning of the pandemic, the government distributed around $5 trillion in pandemic aid through three pieces of legislation, while relying heavily on the applicants’ honesty in applying for the said benefits.

The programs were widely abused by those who gave the government fake names, listed fake businesses and provided other false information while applying for grants and benefits.

There had also been plenty of fraudulent transactions regarding unemployment claims and loan applications, and the efforts of the labor department and the small business administration to screen such applications let obvious cases slip through the cracks. (Related: Jobless claims fraud on the rise as coronavirus boosts unemployment.)

One person collected unemployment benefits from 29 different states; another received ten loans for 10 different non-existent bathroom renovation businesses using the email address of a burrito restaurant; and one Postal Service employee received an $82,900 loan for a business called “U.S. Postal Services.”

The government also distributed aid to dead people, incarcerated individuals and hundreds of nonexistent farms with names like “Deely Nuts” and “Beefy King.”

While it is unclear how much money was stolen from the government through the fraudulent use of the COVID-19 aid programs, it is likely to be in the tens of billions of dollars, said Michael Horowitz, who serves as chairman of the Pandemic Response Accountability Committee.

“Would it surprise me if it exceeded $100 billion? No,” he said.

Government to go after large-scale theft

Because of the massive scale of the issue, many have gone unpunished for abuse and fraud involving pandemic aid programs. Hannibal Ware, who serves as the Small Business Administration inspector general, said that his office isn’t pursuing cases where the stolen amount does not reach $10,000.

Instead, they will be focusing on large-scale theft and organized theft rings.

One of the individuals facing criminal charges is Andrea Ayers, who was accused of creating a consultation franchise that teaches others how to abuse government aid programs. (Related: Initial unemployment claims remain high as recession fears affect the labor market.)

Rapper Nuke Bizzle was also arrested and later pleaded guilty to mail fraud after he discussed false unemployment claims that he made on his YouTube channel. In a song, he bragged about getting 30 prepaid debit cards in the mail in one day from the unemployment programs.

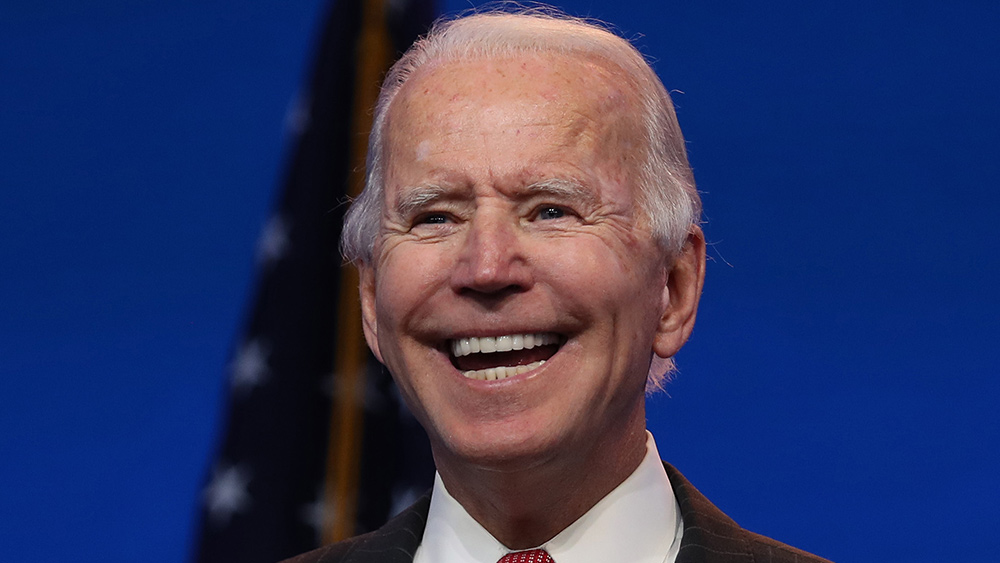

President Joe Biden recently signed a bill designed to help the government prosecute fraud cases related to the pandemic aid. “My message to those cheats out there is this: You can’t hide. We’re going to find you,” Biden said.

A semiannual report released by the Department of Labor to Congress in May said the unprecedented infusion of federal funds into the unemployment insurance program gave individuals and organized criminal groups a high-value target to exploit. Criminals were able to defraud the system due to program weaknesses. They were also able to easily steal personally identifiable information.

Many states were also unprepared to process the number of new claims for benefits and struggled to implement the newly created programs. This means that many traditional internal fraud controls weren’t used, leading to many making fraudulent claims for benefits with a relatively low risk of getting caught, with some getting tens of thousands of dollars.

Much of the criminal activity targeted the temporary programs for gigs, self-employed and other workers.

While lawmakers initially let applicants self-attest to their qualifications, they later rescinded that feature and belatedly added fraud safeguards. The Labor Department has also taken additional fraud-prevention measures, including grant money, to help states upgrade their administrative systems.

Visit Pandemic.news for more news related to the COVID-19 pandemic.

Watch the video below to know more about the end of unemployment benefits.

This video is from The Sword & Shield channel on Brighteon.com.

More related stories:

Jobless claims surge to highest level in 6 months as employers cut jobs due to weakening economy.

Nearly two-thirds of Americans are now living paycheck to paycheck amid inflation crisis.

Inflation relief stimulus checks handed out by states could fuel even more inflation.

Sources include:

Submit a correction >>

Tagged Under:

benefits fraud, Collapse, covid-19 pandemic, crime, fraudulent claims, Inflation, job loss, jobless claims, market crash, unemployment, unemployment assistance, unemployment benefits, unemployment claims, welfare fraud

This article may contain statements that reflect the opinion of the author

Get independent news alerts on natural cures, food lab tests, cannabis medicine, science, robotics, drones, privacy and more from NewsTarget.com

Get independent news alerts on natural cures, food lab tests, cannabis medicine, science, robotics, drones, privacy and more from NewsTarget.com

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 DEBT COLLAPSE NEWS