Coronavirus causes record-breaking 3.2 million Americans to file for unemployment

03/27/2020 / By Franz Walker

A total of 3.2 million people filed for unemployment benefits last week as the economic slowdown caused by the coronavirus outbreak forced layoffs around the U.S. last week. The seasonally adjusted total reported by the Department of Labor (DOL) shattered records, surpassing the previous one of 695,000 initial jobless claims in a single week set in 1982.

The distressingly large number for the week ending on March 21 was 3 million higher than the previous week’s total of 282,000. Experts were expecting a large spike in reported jobless claims this week. The actual numbers however still dwarfed the 1 million applications economists predicted in a recent Reuters survey.

“Millions of Americans are filing for benefits and that means the economy is not just staring down at the abyss, it has fallen off the cliff and down into the depths of recession,” Chris Rupkey, the chief financial economist at MUFG Union Bank, said Thursday.

Rupkey also said that the number may have even been higher, however, if not for the fact that a surge in applications overwhelmed benefits websites in some states.

“There are numerous reports of laid-off workers unable to file for unemployment insurance because so many people are trying to file at the same time,” said Mark Zandi, chief economist at Moody’s Analytics in West Chester, Pennsylvania. “Millions of job losses are likely in coming weeks.”

An unprecedented event in American history

Daniel Zhao, a senior economist at Glassdoor, called the surge a “truly unprecedented event in American history.” The outbreak and the self-isolation measures being put in place to try to contain it has forced businesses to shut down, putting millions of workers out of jobs, effectively “flash freezing” the U.S. economy, according to Zhao.

“Most historical comparisons of this scale are inadequate. The closest would be natural disasters like major hurricanes,” he added. “However, as today’s report shows, the coronavirus outbreak is economically akin to a major hurricane occurring in every state around the country for weeks on end.”

The outbreak, which has let to widespread business closures and lockdown measures in several states, could cause the unemployment rate to match or even exceed the 10 percent peak it hit during the 2007 financial crisis. That crisis saw a total of 8.7 unemployment filings over its course, though it only hit a single week peak of 665,000.

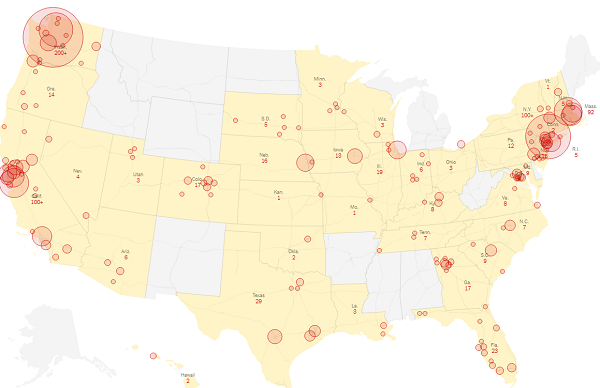

Looking at individual states, unadjusted claims for California, Illinois, Massachusets, New Jersey, Texas and Washington state increased by more than 100,000 last week. Meanwhile, Pennsylvania reported that unadjusted claims increased by over 300,000.

According to the weekly report, states cited the impact of the coronavirus pandemic when reporting their figures. Officials said that service industries continued to take a hit, with other sectors such as health care, arts, entertainment and transportation also contributing to the jump.

The unemployment rate could continue to rise

The increase in unemployment claims from last week will likely have no impact on March’s employment report — last week falls outside the period which the government surveyed employers for nonfarm payrolls, which ended March 14. However, the surge likely indicates an end to a record streak of 113 months of U.S. employment growth that started in October 2010.

The report also showed that the number of people receiving benefits after an initial week of aid increased by 101,000 to 1.80 million for the week ended March 14. This represents the highest since April 2018.

This continuing claims data covered the period from which the government surveyed households for March’s unemployment rate. These continuing claims increased by 110,000 between February and March. Experts are taking this as a hint that the unemployment rate will increase from the current 3.5 percent.

“We would be amazed if it didn’t exceed 10% by May, if not April,” mentioned Paul Ashworth, chief U.S. economist at Capital Economics in Toronto. “The unemployment rate could remain elevated for years.”

Increase in unemployment was “not unexpected”

While huge, the surge in layoffs wasn’t something that government officials hadn’t expected as it stems from the drastic measures needed to slow down and flatten the curve of the virus’ spread.

“This large increase in unemployment claims was not unexpected, and results from the recognition by Americans across the country that we have had to temporarily halt certain activities in order to defeat the coronavirus,” Labor Secretary Eugene Scalia said in a statement.

That said, the White House is eager to get the economy restarted as quickly as possible. President Donald Trump has set a goal of April 12 — Easter Sunday — for restarting the economy. However, even the president is remaining cautious, stating that there was room to adjust depending on how the outbreak plays out. He also mentioned that they were looking at opening certain areas first, including those in the “farm belt” out West as well as rural areas in Texas. The hope seems to be that, even if things don’t go as fully planned, some people will be able to go back to work even as others remain under lockdown.

Sources include:

Tagged Under: Collapse, coronavirus, covid-19, economic collapse, economy, financial crisis, flu, government, infections, jobs, market crash, outbreak, pandemic, President Trump, risk, stocks, superbugs, unemployment, US, US economy, virus, Wall Street

Get independent news alerts on natural cures, food lab tests, cannabis medicine, science, robotics, drones, privacy and more from NewsTarget.com

Get independent news alerts on natural cures, food lab tests, cannabis medicine, science, robotics, drones, privacy and more from NewsTarget.com

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 DEBT COLLAPSE NEWS